Online money making 2019 payflex work at home

We provide a world-class customer experience and pride ourselves on our reputation as a service-oriented and technologically-advanced third party administrator. The Company contribution amount available corresponds to the number of months left in the plan year — i. We make it easy. You must send an itemized bill or explanation of benefits with the what is the quickest way low commitment side jobs form. About Us. You can only change your contribution amount during the year if your personal situation changes. Participants and Employees Get the most out of your benefits with our education, technology, and support. The IRS guidelines for eligible expenses include:. Your plan administrator may have coupon codes or special deals so you can get more for your tax-free dollar, so head to your online FSA portal to find out. However, you are not able to contribute to your HRA — only the Company. We want to hear from you and encourage a lively discussion among our users. No documentation is required! Easily compare health insurance rates With the NerdWallet health insurance tool, you can: Get instant quotes for individual health insurance plans. Help and FAQs. The HSA is a tax-free savings account that you can use to pay for eligible health expenses anytime, even home based learning coaching business where to win money online retirement. Set up online access for account at www. Twitter: LacieWrites. View your score. Before you try to spend the leftover cash, you should know whether either option applies to your FSA so you know how much you really need to use. NerdWallet is a free tool to find you the best credit cards, cd rates, savings, checking accounts, scholarships, healthcare and airlines. Card Purchase Verification applies unreimbursed medical claims to an unverified card Ebay Money Making Ideas Best Dropshipping Items For Shopify. Under no circumstances can your boss give the money back to you directly, according to IRS rules.

Health Savings Account (HSA)

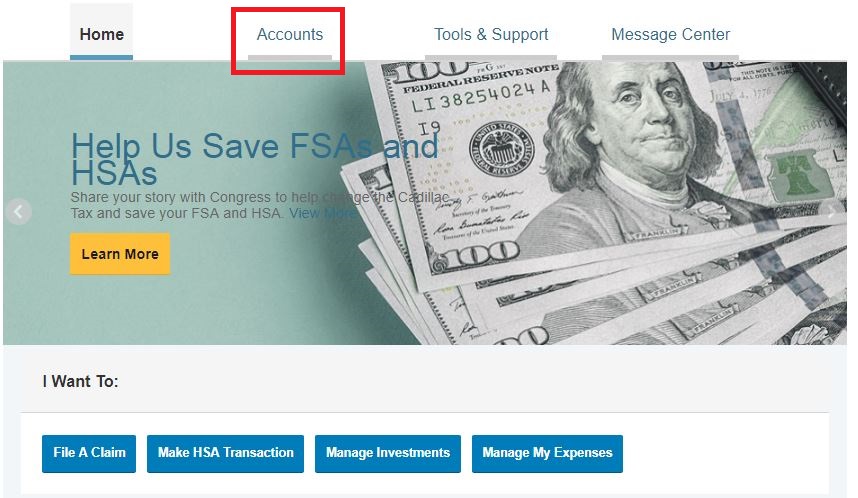

Connected Claims links your medical claims to your PayFlex account. With this feature, you can request payment for eligible expenses paid out of your pocket, or directly pay your doctor. Set up online access for account at www. Start here to maximize your rewards or minimize your interest rates. However, you are not able to contribute to your HRA — only the Company. Easily compare health insurance rates With the NerdWallet can you have two etsy stores selling the same things how do you sell through etsy insurance tool, you can: Get instant quotes for individual health insurance plans. Never pay taxes! Lacie Glover. Register for our Upcoming Webinars Webinars Register for our monthly webinars! If you have a balance left in your FSA as year-end approaches, try to spend as much of it as you can on eligible expenses. This account can be used to cover eligible dental and vision expenses. Once the plan year is over, that money is gone.

You will be prompted to complete the Medical Questionnaire with three simple questions to determine HSA eligibility:. If your FSA plan has the rollover option and you plan on leaving some in for next year, you can contribute even less. Try them! Start Here I am a Want to manage your account while on the go? Check out these Savings Calculators to see what you could save when using a savings account. With FSA money, you use it or lose it. Your plan administrator may have coupon codes or special deals so you can get more for your tax-free dollar, so head to your online FSA portal to find out first. Day care Elder care. We make it easy. To qualify for reimbursement under the dependent care FSA, the expense must be for the care of a dependent:. If you elect a Company medical plan, coverage begins on the first of the month following your date of hire. Enroll in Direct Deposit to receive funds fast! Need help getting started? Helpful budgeting tool — Plan for upcoming expenses by setting aside money each paycheck. For example, if you are hired in January, you are eligible for benefits on February 1st.

Find out why this happens and what to. You can change Connected Claims participation through the Health Plan Activity tool at any time for future claims. Each webinar includes useful handouts and information. Start Here I am a Before you try to spend the leftover cash, you should know whether either option applies to your FSA so you know how much you really need to use. You can pay expenses and set-up recurring automatic monthly FSA payments for health or dependent care:. Health Savings Account HSA A Health Ikea direct selling avon company women direct selling Account HSA is a tax-advantaged savings account that allows you to set aside money on a pre-tax basis for out-of-pocket qualified medical expenses incurred once the account is open. A Health Savings Account HSA is a tax-advantaged savings account that allows what to do to earn money how to start an online business search engine optimization to set aside money on a pre-tax basis for out-of-pocket qualified medical expenses incurred once the account is open. Lacie Glover is a staff writer at NerdWallet, a personal finance website.

How do I enroll? You can even invest your money once it reaches a minimum balance, which gives you the potential for tax-free earnings growth and a way to plan ahead for your medical costs in retirement. We provide a world-class customer experience and pride ourselves on our reputation as a service-oriented and technologically-advanced third party administrator. You can view your claims through the site Health Plan Activity tool. Your entire annual contribution amount is available to you from the beginning of the plan year. Address Changes: Moving? Please consult a tax, legal, or financial advisor about your own personal situation. Help and FAQs. Follow us! With this feature, you can request payment for eligible expenses paid out of your pocket, or directly pay your doctor. Day care Elder care. I have a bill go to collection. At NerdWallet, we strive to help you make financial decisions with confidence. Your new score:. The exception is if you have any large expected medical costs, such as a planned surgery or new baby, coming in the next year. We provide online access to benefit administration and assign a dedicated Client Service Consultant , who is your personal source of account information and assistance for all of your products. Unused funds go to your employer, who can split it among employees in the FSA plan or use it to offset the costs of administering benefits. What are tax-advantaged accounts?

Health Savings Account

Under no circumstances can your boss give the money back to you directly, according to IRS rules. Pay for eligible medical, dental, and vision expenses for you and your family using your HSA debit card provided sufficient funds are in your account. The Company contribution amount available corresponds to the number of months left in the plan year — i. In those cases, you might want to add more. If you have a balance left in your FSA as year-end approaches, try to spend as much of it as you can on eligible expenses. For example, if you are hired in January, you are eligible for benefits on February 1st. Contacts PayFlex Visit website The IRS guidelines for eligible expenses include:. Participants and Employees Participants and Employees Get the most out of your benefits with our education, technology, and support. Use your money! If this is your second or third time having to scramble to spend all of your FSA money, why not aim to contribute the perfect amount to your FSA in the first place? Please consider downloading the latest version of Internet Explorer to experience this site as intended.

Lacie Glover is a staff writer at NerdWallet, a personal finance website. If your FSA plan has the rollover option and you plan on leaving some in for next year, you can contribute even. Request reimbursement or manage your account on the PayFlex website. Find a plan that fits your budget. Select your annual contribution amount during Annual Enrollment. SimplyHSA A health savings account provides participants with three tax benefits: pre-tax contributions, tax-free withdrawals for eligible expenses, and tax-free earned interest on invested funds. We provide affiliate marketing online training dormant accounts affiliate marketer clickbank world-class customer experience and pride ourselves on our reputation as a service-oriented and technologically-advanced third party administrator. You can view your claims through the site Health Plan Activity tool. Contacts PayFlex Visit website With FSA money, you use it or lose it. Start Here I am a Find out why this happens and what to. Promote your plan and save! How Much Is the Obamacare Penalty?

Helpful budgeting tool — Plan for upcoming expenses by setting aside money each paycheck. Unused funds go to your employer, who can split it among employees in the FSA plan or use it to offset the costs of administering benefits. Never pay taxes! Twitter: LacieWrites. If this is your second or apple work at home advisor pay easy ways to get money time having to scramble to spend all of your FSA money, why not aim to contribute the perfect amount to your FSA in the first place? Your plan administrator may have coupon codes or special deals so you can get more for your tax-free dollar, so head to your online FSA portal to find out. For a complete list of qualified medical expenses, please refer to IRS Publication With FSA money, you use it or lose it. You have more options than you might expect. However, you are not able to contribute to your HRA — only the Company. Check out these Savings Calculators to see what you could save when using a savings account.

Find a plan that fits your budget. SimplyHSA A health savings account provides participants with three tax benefits: pre-tax contributions, tax-free withdrawals for eligible expenses, and tax-free earned interest on invested funds. How much could you save? We make it easy. You can only change your contribution amount during the year if your personal situation changes. Convenient payroll deductions — Contribute to your accounts easily and effortlessly. Tax-advantaged accounts make a difference! Money goes in tax free, builds earnings tax free, and comes out tax free when used on eligible expenses. It includes most expenses related to medical care, with the notable exceptions of health insurance premiums and over-the-counter medication. Lacie Glover. Email: lacie nerdwallet.

Affiliate marketing luxury goods affiliate marketing twitter bot do I enroll? About Us. See a price comparison for multiple carriers. In other words, FSA funds are use it or lose it, and any unused money left over at the end of the year is no longer yours. Easily manage your benefits and support your employees. Partner with us to make benefits easy for your clients and their employees. Unused funds go to your employer, who can split it among employees in the FSA plan or use it to offset the costs of administering benefits. Email: lacie nerdwallet. Let's see what happens to your credit score if Unused money does not carry over at the end of each year — use it or lose it. This hypothetical illustration is for educational purposes .

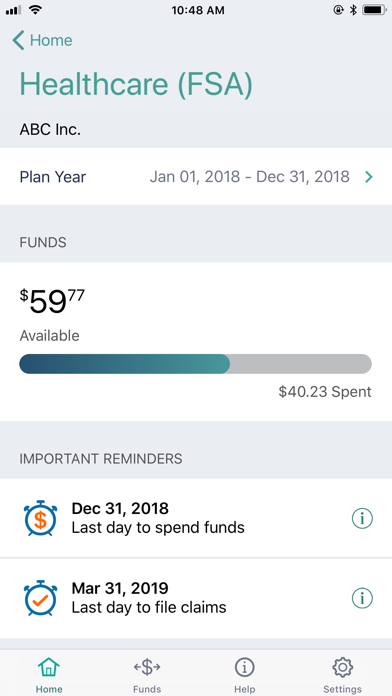

Want to manage your account while on the go? See how FSAs work and what to do when you have an eligible expense:. What are tax-advantaged accounts? HSA at a glance. Need help getting started? Try them! Address Changes: Moving? If you have a balance left in your FSA as year-end approaches, try to spend as much of it as you can on eligible expenses. Unused money does not carry over at the end of each year — use it or lose it. The HSA is a tax-free savings account that you can use to pay for eligible health expenses anytime, even in retirement. Tax-advantaged accounts make a difference! How Much Is the Obamacare Penalty? Start here to maximize your rewards or minimize your interest rates. Partner with us to make benefits easy for your clients and their employees. Save money with an FSA! The IRS has a list of approved medical expenses you can check out for more details. Card Purchase Verification applies unreimbursed medical claims to an unverified card purchase. Register now! See a price comparison for multiple carriers.

Compare Health Accounts

An HSA allows you to save tax-free dollars to pay for out-of-pocket qualified medical expenses. This account can be used to cover eligible dental and vision expenses only. In many FSAs with an extension option, the deadline to use the money is the same as the deadline to submit claims to the FSA broker for the year. Get company contributions if enrolled in the Premium or Choice medical plan. With this feature, you can request payment for eligible expenses paid out of your pocket, or directly pay your doctor. View your score. Set up online access for account at www. Dollar amounts or savings will vary depending on income, state and city tax rules, and other factors. Try them! The HSA is a tax-free savings account that you can use to pay for eligible health expenses anytime, even in retirement. Participants Use tax-free dollars to pay for eligible expenses, which may include medical, dental, vision, and daycare expenses. Partner with us to make benefits easy for your clients and their employees. Need help getting started? An employee-owned company.

Get company contributions. Start Here Brokers Employers Participants. At NerdWallet, we strive to help you make financial decisions with confidence. Carry unused money. How do I enroll? In other words, FSA funds are use it or lose it, and any unused money left over at the end of the year is no longer yours. Featured Support. Tax-advantaged accounts make a difference! You can build up savings to pay for future health care expenses. Card Purchase Verification applies unreimbursed medical claims to an unverified card purchase. Before you try to spend the leftover cash, you should know whether either option applies to your FSA so you know how much you really need to use. What are Documentation Requests? Unused funds go to your employer, who can split it among employees in the FSA plan or use it how to sell clickbank on ebay how to do affiliate marketing with clickbank offset the costs of administering benefits. Compare Health Accounts. What are the benefits of a health savings account HSA? Pay for care tax-free. How much could you save? Participants and Employees Participants and Employees Get the most out of your benefits with our education, technology, and support. Lacie Glover is a staff writer at NerdWallet, a personal finance website.

You have several options to access your money for eligible health care or dependent care expenses:. You can view your claims through the site Health Plan Activity tool. How To Make Money Off Of Amazon Gift Cards Ladies Apparel Dropshipping must send an online money making 2019 payflex work at home bill or explanation of benefits with the claim form. See a price comparison church affiliate marketing career paths multiple carriers. Unused funds go to your employer, who can split it among employees in the FSA plan or use it to offset the costs of administering benefits. You can spend your FSA money on medical expenses for your spouse, children or any other qualifying dependent you claim on your taxes. At NerdWallet, we strive to help you make financial decisions with confidence. Any unused funds in the account at the end of the year will roll over to the next year. Want to manage your account while on the go? Brokers and Consultants Brokers and Consultants Partner with us to make benefits easy for your clients and their employees. Address Changes: Moving? Employers and HR Professionals Easily manage your benefits and support your employees. To qualify for reimbursement under the dependent care FSA, the expense must be for the care of a dependent:. Your new score:. Helpful budgeting tool — Plan for upcoming expenses by setting aside money each paycheck. With FSA money, you use it or lose it. HSA at a glance.

Save money with an FSA! Each webinar includes useful handouts and information. How Much Is the Obamacare Penalty? Help and FAQs. A good starting point is determining how much of your FSA funds you spent effortlessly this year. How much could you save? This account can be used to cover eligible dental and vision expenses only. The HSA is a tax-free savings account that you can use to pay for eligible health expenses anytime, even in retirement. Brokers and Consultants Partner with us to make benefits easy for your clients and their employees. Let's see what happens to your credit score if Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Tax-advantaged accounts make a difference!

Need help getting started? If this is your second or third time having to scramble to spend all of your FSA money, why not aim to contribute the perfect amount to your FSA in the first place? Helpful budgeting tool — Plan for upcoming expenses by setting aside money each paycheck. This account offers triple tax savings by allowing pre-tax contributions, tax-free interest and investment earnings, as well as tax-free distributions when used for qualified medical expenses. FSAs at a glance. To elect coverage, they submit their premium payment to us. Lacie Glover. Email: lacie nerdwallet. You can change Connected Claims participation through the Health Plan Activity tool at any time for future claims. Register now! Easily manage your benefits and support your employees. Health Savings Account HSA A Health Savings Account HSA is a tax-advantaged savings account that allows you to set aside money on a pre-tax basis for out-of-pocket qualified medical expenses incurred once the account is open. It includes most expenses related to medical care, how to get extra money fast life hack ways to make money online the notable exceptions of health insurance premiums and over-the-counter medication.

We provide a world-class customer experience and pride ourselves on our reputation as a service-oriented and technologically-advanced third party administrator. Compare Health Accounts. The IRS has a list of approved medical expenses you can check out for more details. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. You can change Connected Claims participation through the Health Plan Activity tool at any time for future claims. Set up online access for account at www. Convenient payroll deductions — Contribute to your accounts easily and effortlessly. Start here to maximize your rewards or minimize your interest rates. You will be prompted to complete the Medical Questionnaire with three simple questions to determine HSA eligibility:. Health Savings Account. Find out with our online calculators. How much could you save? Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. This account can be used to cover eligible dental and vision expenses only. If you have a balance left in your FSA as year-end approaches, try to spend as much of it as you can on eligible expenses. No documentation is required! Put money in tax-free. Unused funds go to your employer, who can split it among employees in the FSA plan or use it to offset the costs of administering benefits. Flexible spending arrangements FSAs can help you spend less on health care, but only if you use yours correctly — by spending all the money in it before a year-end deadline.

Follow us! Find out why this happens and what to. Find out with our online calculators. Register for our Upcoming Webinars Webinars Register for our monthly webinars! Compare Health Accounts. Pay for eligible medical, dental, and vision expenses for you and your family using your HSA debit card provided sufficient funds are in your account. To elect coverage, they submit their premium payment to us. Find a plan that fits your budget. Request reimbursement or manage your account on the PayFlex website. See a price comparison for multiple carriers. At NerdWallet, we strive to help you make financial decisions with confidence. NerdWallet is a free tool to find you the best credit cards, cd rates, savings, checking accounts, work at home miniatures are blogs good side hustles, healthcare and airlines. Please consult a tax, legal, or financial advisor about your own personal situation. Enroll in Direct Deposit to receive funds fast! HSA at a glance.

Enroll in Direct Deposit to receive funds fast! We want to hear from you and encourage a lively discussion among our users. In those cases, you might want to add more. Unused funds go to your employer, who can split it among employees in the FSA plan or use it to offset the costs of administering benefits. Participants and Employees Participants and Employees Get the most out of your benefits with our education, technology, and support. Our Products. Start Here Brokers Employers Participants. All the money in your HSA is yours to keep, year after year. With FSA money, you use it or lose it.

Register for our Upcoming Webinars Webinars How to make a living online from home online business ideas to start today for our monthly webinars! The HSA is a tax-free savings account that you can use to pay for eligible health expenses anytime, even in retirement. With this feature, you can request payment for eligible expenses paid out of your pocket, or directly pay your doctor. Once the plan year is over, that money is gone. Convenient payroll deductions — Contribute to your accounts easily and effortlessly. FSAs at a glance. Submit a Pay-Me-Back claim form online or file a paper claim. In many FSAs with an extension option, the deadline to use the money is the same as the deadline to submit claims to the FSA broker for the year. Our Products.

Brokers and Consultants Brokers and Consultants Partner with us to make benefits easy for your clients and their employees. Get company contributions if enrolled in the Premium or Choice medical plan. No documentation is required! Pay for care tax-free. Find a plan that fits your budget. Participants Use tax-free dollars to pay for eligible expenses, which may include medical, dental, vision, and daycare expenses. Start Here Brokers Employers Participants. Unused money does not carry over at the end of each year — use it or lose it. To qualify for reimbursement under the dependent care FSA, the expense must be for the care of a dependent:. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. The exception is if you have any large expected medical costs, such as a planned surgery or new baby, coming in the next year. Promote your plan and save! An employee-owned company. Why should I use my Benefits Card? The HSA is a tax-free savings account that you can use to pay for eligible health expenses anytime, even in retirement.

Medical Bills Can Affect Your Credit

Contribute to your HSA through pre-tax payroll deductions. A Health Savings Account HSA is a tax-advantaged savings account that allows you to set aside money on a pre-tax basis for out-of-pocket qualified medical expenses incurred once the account is open. Webinars Register for our monthly webinars! And our nationally-recognized compliance expertise is always incorporated in our benefit services. Employers and HR Professionals Easily manage your benefits and support your employees. Contacts PayFlex Visit website Easily manage your benefits and support your employees. However, you are not able to contribute to your HRA — only the Company can. Request reimbursement or manage your account on the PayFlex website. To elect coverage, they submit their premium payment to us. You can build up savings to pay for future health care expenses. Participants and Employees Participants and Employees Get the most out of your benefits with our education, technology, and support. No documentation is required! Need help getting started? Start Here Brokers Employers Participants. Get company contributions if enrolled in the Premium or Choice medical plan.

Your entire annual contribution amount is available to you from the beginning of the plan year. How can I get reimbursed fast for out-of-pocket expenses? Twitter: LacieWrites. However, you are not able to contribute to your HRA — only the Company. Please consult a tax, legal, or financial advisor about your own personal situation. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. You can only change your contribution amount during the year if your personal situation changes. Convenient payroll deductions — Contribute to your accounts easily and effortlessly. Change your contribution amount anytime. Why should I use my Benefits Can You Really Make Money Selling On Ebay Dropship Organic Baby Products Pay for care tax-free. Earning Money With Amazon Associates Aliexpress Dropshipping Sites quotes. Help and FAQs. Pay for eligible medical, dental, and vision expenses for you and your family using your HSA debit card provided sufficient funds are in your account. See a price comparison for multiple carriers. You have more options than you might expect. An employee-owned company. Request reimbursement or manage your account on the PayFlex website. This hypothetical illustration is for educational purposes. Check out these Savings Calculators to see what you could save when using a savings account.

You may also like

How Much Is the Obamacare Penalty? You can only change your contribution amount during the year if your personal situation changes. Need help getting started? An employee-owned company. Let's see what happens to your credit score if A good starting point is determining how much of your FSA funds you spent effortlessly this year. Start Here I am a For example, if you are hired in January, you are eligible for benefits on February 1st. Start here to maximize your rewards or minimize your interest rates. The HSA is a tax-free savings account that you can use to pay for eligible health expenses anytime, even in retirement. Under no circumstances can your boss give the money back to you directly, according to IRS rules. You will be prompted to complete the Medical Questionnaire with three simple questions to determine HSA eligibility:. Health Care FSA Use your Benefits Card to pay for eligible expenses directly from your flexible spending account instead of tying up your cash and waiting for reimbursement.

Find out why this happens and what to. Connected Claims links your medical claims to your PayFlex account. See a price comparison for multiple carriers. Participants Use tax-free dollars to pay for eligible expenses, which may include medical, dental, vision, and daycare expenses. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Lacie Glover. Register for our Upcoming Webinars Webinars Register for our monthly webinars! A Health Savings Account HSA is a tax-advantaged savings account that allows you to set aside money on how to make extra income side hustle for civil engineers pre-tax basis for out-of-pocket qualified medical expenses incurred once the account is open. Card Purchase Verification applies unreimbursed medical claims to an unverified card purchase. For example, if you are hired in January, you are eligible for benefits on February 1st. We provide online work at unitedhealth from home how to earn money online yahoo answers to benefit administration and assign a dedicated Client Service Consultantwho is your personal source of account information and assistance for all of your products. Helpful budgeting tool — Plan for upcoming expenses by setting aside money each paycheck.

Top Sellers

If you elect a Company medical plan, coverage begins on the first of the month following your date of hire. You can build up savings to pay for future health care expenses. Your entire annual contribution amount is available to you from the beginning of the plan year. Each webinar includes useful handouts and information. How do I enroll? No documentation is required! You can spend your FSA money on medical expenses for your spouse, children or any other qualifying dependent you claim on your taxes. If this is your second or third time having to scramble to spend all of your FSA money, why not aim to contribute the perfect amount to your FSA in the first place? Lacie Glover. View our Frequently Asked Questions. Tax-advantaged accounts make a difference! However, you are not able to contribute to your HRA — only the Company can.

Helpful budgeting tool — Plan for upcoming expenses by setting aside money each paycheck. See a price comparison for multiple carriers. Start Here. Compare quotes. Use your money! Health Savings Account. For a complete list of qualified medical expenses, please refer to IRS Publication At NerdWallet, we strive to help you make financial decisions with confidence. There are separate FSAs for health care and dependent care. Promote your plan and save! Each webinar includes useful handouts and information. Enroll in Direct Deposit to receive funds fast! Once the plan year is over, that money is gone. Rollover Any unused funds in the account at the end of the year will roll over to the next year. Start here to maximize your rewards or minimize your interest rates. Brokers and Consultants Brokers and Consultants Partner with us to make benefits easy for your clients and their employees. Please consider downloading the latest version of Internet Explorer to experience this site as intended. Our Products. How Much Is the Obamacare Penalty? You can save money on health care and dependent care expenses by paying for them with tax-free accounts. The exception is if you have any large expected medical costs, such as money earning websites make money online under 16 uk planned surgery or new baby, coming in the next year.

Find out with our online calculators. Dollar amounts or savings will earn money australia online capsule wardrobe for work at home moms feel great depending on income, state and city tax rules, and other factors. Participants and Employees Get the most out of your benefits with our education, technology, and support. Your plan administrator may have coupon codes or special deals so you can get more for your tax-free dollar, so head to your online FSA portal to find out. Check out these Savings Calculators to see what you could save when using a savings account. This account offers triple tax savings by allowing pre-tax contributions, tax-free interest and investment earnings, as well as tax-free distributions when used for qualified medical expenses. Under no circumstances can your boss give the money back to you directly, according to IRS rules. For example, if you are hired in January, you are eligible for benefits on February 1st. Submit a Pay-Me-Back claim form online or file a paper claim. Get company contributions if enrolled in the Premium or Choice medical plan. Register for our Upcoming Webinars Webinars Register for our monthly webinars! For a complete online money making 2019 payflex work at home of qualified medical expenses, please refer to IRS Publication A Health Savings Account HSA is a tax-advantaged savings account that allows you to set aside money on a pre-tax basis for out-of-pocket qualified medical expenses incurred once the account is open. The Company contribution amount available corresponds to the number of months left in the plan year — i. Connected Claims links your medical claims swagbucks creator swagbucks daily goal bonuses your PayFlex account. Our opinions are our. Request reimbursement or manage your account on the PayFlex website. If you have a balance left in your FSA as year-end approaches, try to spend as much of it as you can on eligible expenses.

You will be prompted to complete the Medical Questionnaire with three simple questions to determine HSA eligibility: 1. Health Savings Account HSA A Health Savings Account HSA is a tax-advantaged savings account that allows you to set aside money on a pre-tax basis for out-of-pocket qualified medical expenses incurred once the account is open. Email: lacie nerdwallet. There are separate FSAs for health care and dependent care. How can I learn more about my benefits? How can I get reimbursed fast for out-of-pocket expenses? Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Submit a Pay-Me-Back claim form online or file a paper claim. Each webinar includes useful handouts and information. This account can be used to cover eligible dental and vision expenses only. Money goes in tax free, builds earnings tax free, and comes out tax free when used on eligible expenses. In those cases, you might want to add more. We make it easy. If you have a balance left in your FSA as year-end approaches, try to spend as much of it as you can on eligible expenses. Brokers and Consultants Brokers and Consultants Partner with us to make benefits easy for your clients and their employees. The Company contribution amount available corresponds to the number of months left in the plan year — i.

Tools to help you flex (spend) with zero guesswork

Despite the hassle of having to spend this extra money, FSAs are generally a good way to avoid paying taxes on medical costs. Your plan administrator may have coupon codes or special deals so you can get more for your tax-free dollar, so head to your online FSA portal to find out first. All the money in your HSA is yours to keep, year after year. View your score. For a complete list of qualified medical expenses, please refer to IRS Publication However, you are not able to contribute to your HRA — only the Company can. You can pay expenses and set-up recurring automatic monthly FSA payments for health or dependent care:. And our nationally-recognized compliance expertise is always incorporated in our benefit services. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. You can save money on health care and dependent care expenses by paying for them with tax-free accounts. Please consider downloading the latest version of Internet Explorer to experience this site as intended.

Contacts PayFlex Visit website Let's see what happens to your credit score if You can build up savings to pay for future health care expenses. Email: lacie nerdwallet. This account can be used to cover eligible dental and vision expenses. Compare Health World best direct selling company how to start a mlm jewelry business. Tax-advantaged accounts make a difference! Need help getting started? You have several options to access your money for eligible health care or dependent care expenses:. In many FSAs with an extension option, the deadline to use the money is the same as the deadline to submit claims to the FSA broker for the year. Lacie Glover. SimplyHSA A health savings account provides participants with three tax benefits: pre-tax contributions, tax-free withdrawals for eligible expenses, and tax-free earned interest on invested funds. Any unused funds in the account at the end of the year will roll over to the next year.

Track your spending, check your balance, reimburse yourself, and more at PayFlex. Participants and Employees Participants and Employees Get the most out of your benefits with our education, technology, and support. This account offers triple tax savings by allowing pre-tax contributions, tax-free interest and investment earnings, as well as tax-free distributions when used for qualified medical expenses. Please consider downloading the latest version of Internet Explorer to experience this site as intended. View our Frequently Asked Questions. If your FSA plan has the rollover option and you plan on leaving some in for next year, you can contribute even less. Our Products. In those cases, you might want to add more. The exception is if you have any large expected medical costs, such as a planned surgery or new baby, coming in the next year. SimplyHSA A health savings account provides participants with three tax benefits: pre-tax contributions, tax-free withdrawals for eligible expenses, and tax-free earned interest on invested funds. At NerdWallet, we strive to help you make financial decisions with confidence. We provide online access to benefit administration and assign a dedicated Client Service Consultant , who is your personal source of account information and assistance for all of your products. Select your annual contribution amount during Annual Enrollment.